Comprehensive Guide to Industrial Water Treatment Equipment: Technology, Applications, and Investment Insights

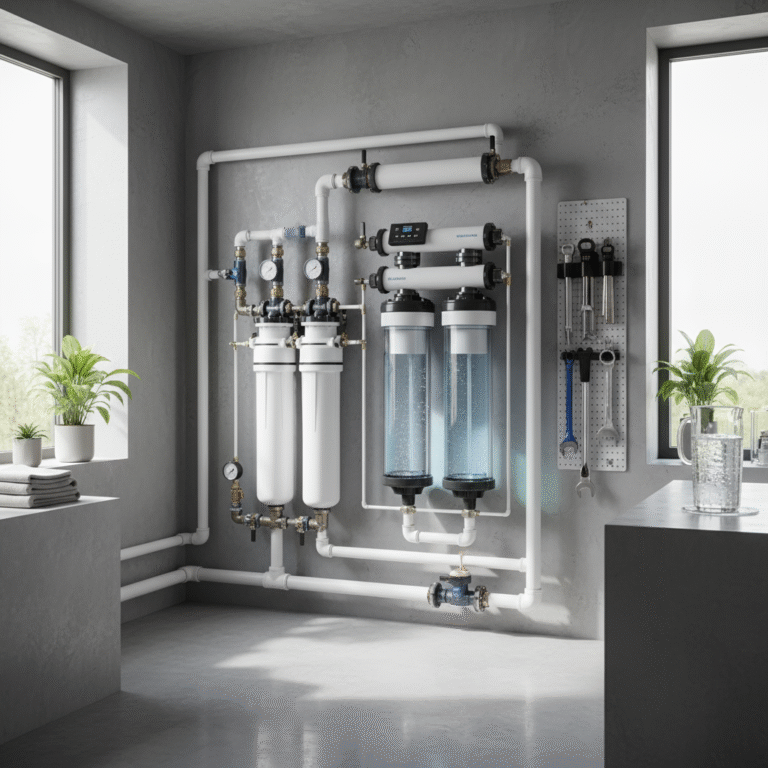

Industrial water treatment equipment plays a pivotal role in ensuring water quality and safety across multiple sectors, including mining, food processing, pharmaceuticals, cosmetics, laboratories, and municipal water systems. This article presents an in-depth examination of the various types, technical principles, pricing structures, performance metrics, market applications, and strategic considerations associated with these sophisticated systems.

1. Product Overview: Types, Functions, and Industry Applications

Industrial water treatment systems are engineered to meet diverse water quality requirements by removing contaminants, adjusting chemical composition, and ensuring compliance with environmental and industry-specific standards. The primary types include:

- Membrane systems: Utilizing microfiltration, ultrafiltration, nanofiltration, and reverse osmosis to separate impurities.

- Chemical treatment units: Adding or removing chemicals to adjust pH, hardness, or disinfect water.

- Filtration units: Mechanical screens, activated carbon filters to eliminate suspended solids and odors.

- Advanced oxidation and UV sterilizers: Targeting organic compounds and microorganisms.

These systems are widely applicable in:

- Mining: Treating brackish or heavily contaminated mining effluent to meet discharge or reuse standards.

- Food and beverage processing: Ensuring potable and process water free from microbial or chemical contaminants.

- Pharmaceutical and cosmetics industries: Demanding ultrapure water for formulations and cleaning.

- Laboratories: Requiring consistent ultrapure water for experiments and equipment.

- Municipal sources: Treating river, underground, or well water to potable standards.

- Boiler and cooling systems: Controlling hardness, corrosion, and scaling to protect equipment.

2. Technical Principles and Core Components

The heart of many modern industrial water treatment systems lies in membrane separation technologies, complemented by automation controls:

Membrane Separation Technology

Membranes act as selective barriers allowing water molecules to pass while retaining dissolved salts, microorganisms, and suspended solids. Key types:

| Membrane Type | Purpose | Particle Size Rejected |

|---|---|---|

| Microfiltration | Removing suspended solids, bacteria | 0.1 – 10 microns |

| Ultrafiltration | Removing viruses, colloids | 0.01 – 0.1 microns |

| Nanofiltration | Removing divalent ions, organic molecules | ~0.001 microns |

| Reverse Osmosis (RO) | Removing monovalent salts, heavy metals | ~0.0001 microns |

Automation Control Systems

Advanced control units are integrated for:

- Real-time monitoring of water quality parameters (TDS, pH, flow rate)

- Automatic adjustment of dosing pumps and filtration cycles

- Remote diagnostics and alerts to minimize downtime

Automation dramatically enhances operational reliability and optimizes resource use, reducing manual interventions and human errors.

3. Price Breakdown: Capital and Operational Considerations

The cost composition of industrial water treatment equipment generally comprises:

- Base system cost: Includes membranes, pumps, filters, and control units. This may vary significantly by capacity and technology sophistication.

- Auxiliary modules: Pretreatment units (e.g., sediment filters), chemical dosing, UV sterilizers, and post-treatment polishing systems.

- Installation and commissioning: Site preparation, civil works, labor, and testing.

- Operating expenses: Energy consumption, membrane replacement, chemical supplies, and maintenance labor.

While initial investments might be substantial, many operators find that system longevity, reduced water waste, and lower chemical use offer excellent total cost of ownership. For example, in a recent deployment I led for a pharmaceutical facility, the RO system attained up to 30% energy savings over prior models, significantly shortening ROI timelines.

4. Performance Specifications and Quality Assurance

Critical performance indicators for industrial water treatment equipment include:

- Flow Rate Capacity: Ranges from a few cubic meters per hour (m³/h) to several thousand, scaled per industrial needs.

- Purification Efficiency: Typically 95-99.9% contaminant removal depending on technology.

- Material Standards: Use of corrosion-resistant stainless steel (SS304, SS316), FDA-compliant plastics, and NSF-certified components.

- Pressure Ratings and Durability: Operating pressures around 2–8 bar for membranes, designed for prolonged usage cycles.

Quality assurance protocols often entail rigorous factory acceptance tests, continuous inline sensors during operation, and periodic validation to meet ISO and customer-specific standards.

5. Market Landscape and Application Context

The industrial water treatment market is expanding rapidly driven by heightened regulatory requirements and growing environmental awareness. Globally, the sector is forecasted to grow at a compound annual growth rate (CAGR) of approximately 5.5% through 2035, fueled by innovations in membrane technology and automation control (according to MarketsandMarkets, Residential Water Treatment Market Report, 2024).

Specific application scenarios vary greatly. For instance:

- Mining operations located in arid areas utilize advanced treatment to recycle process water, minimizing freshwater intake and environmental impact.

- Food processing plants require strict microbial control and water clarity to comply with safety standards and product quality benchmarks.

- Municipal water suppliers integrate whole house systems and point-of-use filters to ensure consistent potable water across distribution networks.

Each sector demands tailored configurations balancing operational continuity with environmental compliance and cost-efficiency.

6. Case Studies: Real-World Implementation Insights

During a recent project in the cosmetics industry, we installed a multi-stage water purification system combining ultrafiltration with ultraviolet sterilization. The client faced challenges with microbial contamination affecting product stability. Post-installation, microbial counts in feed water dropped from 104 CFU/ml to below detection limits, dramatically reducing batch rejections by 85%. This translated into an annual cost saving exceeding $120,000.

In another instance, a mining site deployed an automated reverse osmosis system for onsite water recycling. The system’s automation enabled continuous performance monitoring, reducing downtime by 40% and dropping water procurement expenses by nearly 35%. The client reported improved environmental compliance and operational resilience.

7. Customization Options and After-Sales Service

Water treatment systems are rarely “one-size-fits-all.” Customization options typically include:

- Pre-treatment modules such as sand filtration or chemical dosing for site-specific water conditions.

- Post-treatment polishing, including mineralization or pH adjustment for user-specific water quality targets.

- Scalable automation control upgrades to integrate with existing facility management systems.

Robust after-sales support is vital. Expert installation teams ensure seamless startup, train operators, and provide responsive maintenance contracts. Remote monitoring services and spare parts logistics significantly minimize unplanned outage risks.

8. Manufacturer Credibility and Strategic Benefits

Leading manufacturers distinguish themselves through strong R&D capabilities, compliance with international certifications (ISO, NSF), and success in delivering tailored solutions worldwide. Partnering with a reputable supplier improves risk mitigation, guarantees quality, and speeds technical support turnaround.

Furthermore, collaborations often yield continuous system optimizations, leveraging operational data analytics and emerging technologies to maintain competitive advantages.

9. Conclusion and Investment Recommendations

Industrial water treatment equipment represents a critical investment for diverse industrial sectors aiming to meet regulatory demands, enhance sustainability, and optimize operational costs. The marriage of membrane separation technology and automation solutions yields high precision, efficiency, and adaptability.

Given the comprehensive technical and economic landscape, investors and operators should prioritize solutions offering:

- Modular, scalable design to adjust for future capacity growth.

- Robust automation for real-time management and reduced labor costs.

- Proven track records demonstrated by performance data and successful case studies.

- Full service support, covering installation, training, and maintenance.

Strategic procurement decisions guided by these criteria can ensure superior return on investment, regulatory compliance, and operational resilience in the evolving water treatment market.

References

According to MarketsandMarkets’ “Residential Water Treatment Market Size, Share Report 2034”, the global residential water treatment sector is forecasted to grow from $22.7 billion in 2024 to $41.1 billion by 2035 at a CAGR of 5.53%, driven by water quality concerns, technology innovations, and regulatory support.

Research and Markets’ “Residential Drinking Water Treatment Equipment Market Size” further forecasts a $5.53 billion market expansion between 2024 and 2029 with a 7.1% CAGR, confirming the sector’s rapid growth trajectory and diversification of treatment technologies including membrane systems, UV sterilizers, and ion exchange units.